What is Funeral Insurance and Why Do You Need It?

Funeral insurance policies are the best way to ensure your funeral costs are covered. The cost for a funeral in Canada can easily reach $10,000. This is not an expense that many grieving family members can easily afford. Planning ahead for this final event and putting in place a funeral insurance policy will reduce the burden on your surviving loved ones. Funeral insurance is, basically, a small life insurance policy that is big enough to cover your final expenses.

We offer funeral insurance policies for seniors that can be purchased without a medical examination. Find out more about this insurance below.

Get Your Free Funeral Insurance Quote

Funeral Insurance: Expert Summary

“Funeral Insurance is life insurance designed to cover funeral expenses. Coverage limits can be anywhere from $5,000 to $10,000 or up to $25,000 or, sometimes, a little bit higher but you wanna make sure that you have enough coverage to cover all the necessary costs related to the funeral.

The great thing about the policies available to cover funeral expenses is that benefit is tax-free, and we have a variety of plans available now. You can do a No Medical type policy where there are no medical tests and a series of health questions. With those No Medical policies you want to make sure that you find a plan where you can answer “No” to as many questions as possible. This will result in you paying the lower premium.

It will also allow you to find plans that are available where there is no waiting period. Some No Medical policies where there is a very short series of questions may have a waiting period. So, if you pass away in the first two years, your death benefit may be limited to a return of premium whereas other No Medical policies’ death benefit starts off on an immediate basis, so it pays off from day one.

That’s where you gonna wanna work with a broker who can make sure that they find the best possible plan for you at the best possible price.”

How high are funeral insurance costs in Canada

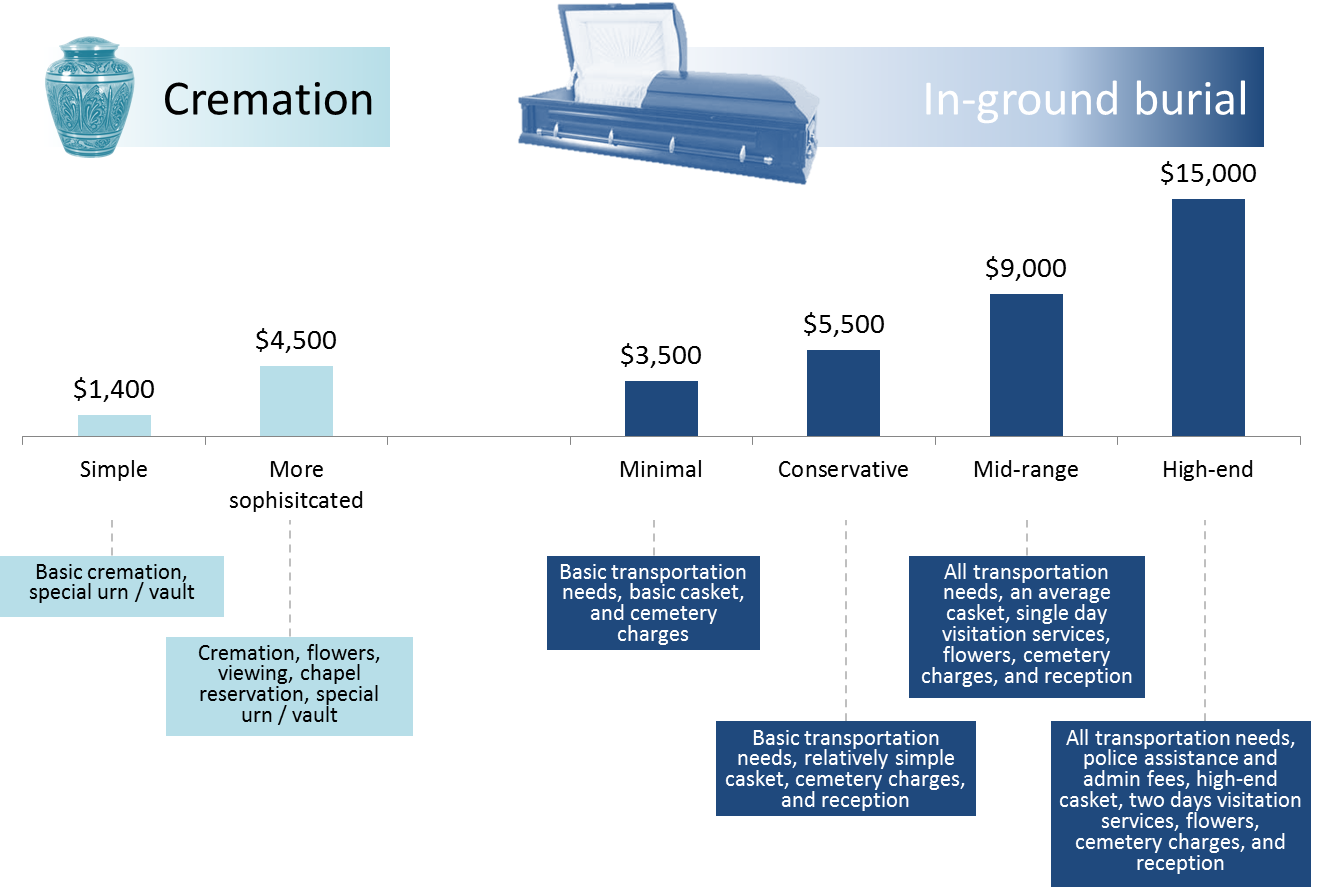

There are two major funeral alternatives in Canada: cremation and in-ground burial. As per chart below, cremation costs typically range between $1,500 and $4,500. In-ground burial is more expensive with costs ranging between $3,500 and $15,000+. These are the costs that you loved ones have to carry should you pass away. Funeral Insurance offers a way to take care of these costs in advance.

Why is it difficult for seniors to get Life Insurance

Seniors face many challenges in obtaining affordable life insurance. Their age range along with any medical conditions can make it difficult to get approval on many types of policies, yet seniors should not overlook the importance of being properly covered.

We understand the importance of insurance and know how difficult and frustrating purchasing a life insurance policy can be for seniors. Talk to our insurance advisors about being able to purchase a seniors’ funeral insurance policy.

This small policy will make all of the difference in the event of your death. Your surviving family will already be faced with the tragic ordeal of your passing. Do not add compounding bills to their grief. Take the time to plan ahead and have a policy in place to cover your funeral expenses. This will not only ensure that your resting bills will not be their out of pocket expense, it also helps to ensure that your final wishes can be carried out as you had wished.

Take the time now to be sure that your family is properly prepared to cover the financial side of these events later, when the time comes.

Difference between Funeral Insurance and other insurance policies

It is important to understand the difference between a seniors’ funeral insurance plan and other types of life insurance (e.g. Term Life Insurance, Whole Life Insurance).

Term Life insurance is a policy that will be in place for a set time and then will expire. It can be renewed until a certain age of the policy holder. Most term life insurance policies will not be able to be renewed once a policyholder becomes a senior.

Whole life insurance is a policy that will remain in place for the duration of the policyholder’s lifetime. It will not expire with age. A whole life insurance policy will have a much greater overall benefit for the policy holder’s beneficiaries. If you do not have this policy in place already, it might be challenging to get it as a senior.

A seniors’ funeral insurance policy is designed to be a much smaller policy, providing enough money to cover only the funeral and burial expenses. It is much easier to get than larger life insurance policies.

Also, if you have pre-existing medical conditions, a seniors’ funeral insurance policy is an option for you. This financially smaller policy will have a significantly lower premium. As these policies are designed for seniors, there is very little chance of you being disqualified from being able to obtain one. In addition, these can also be purchased without having to complete a medical questionnaire (i.e. Simplified Life insurance or Guaranteed Life Insurance).